Contents

Under most circumstances, traders usually use the 50-day SMA as a filer for future trends and trade only in the direction of the more significant and larger trend movement. The pattern works on all time frames across most liquid instruments. However, you should be able to notice that the higher time frames, such as the daily and weekly tend to work more efficiently and manage to perform the best using this strategy. This would provide an excellent opportunity to short the market price and trends immediately after the Evening star formation is completed. The relative strength index indicator tended to rise during the higher price sequence. Then there is the third candle with a solid bearish candle which will close beyond the halfway point of the first candle.

The stop loss would be placed just above the highest high of the Evening star formation as can be seen by the black dashed line noted as, Stop. From here, we would project a price target based on the size of the Evening star formation. Remember we will be projecting downward from the lowest low of the pattern. One way that they can achieve this is by exiting half their position at the 1X mark, and then exit the balance of their position at the 2X mark. The take profit level will be based on the size of the entire Evening star formation from high to low. Specifically, the target will be set at twice the length of the entire Evening star formation.

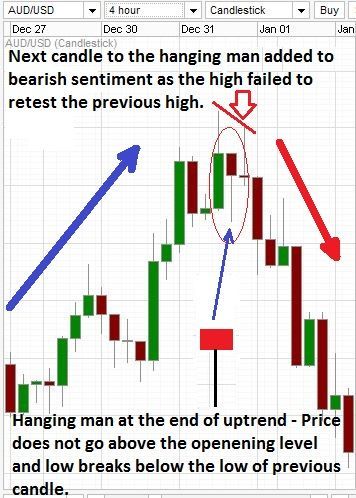

Now, after a handful of candles following the shooting star pattern which pushed the prices lower, the market once again begins to gain upward momentum. As a price moves into the resistance level, the market forms another bearish reversal candlestick pattern. A candlestick chart is popular amongst technical analysts nostro vostro loro when identifying a morning star forex pattern. The candlestick chart is used to predict or anticipate price action of a derivative, currency, or security over a short period. The pattern formed is known as the morning star pattern forex. As with most candlestick patterns, there is also an inverse version.

What is an Evening Star Candlestick?

FairForexBrokers.com does not recommend any forex, crypto and binary brokers or exchanges to US traders besides NADEX, which is licensed by CFTC. Every trader is obligated to check the legal status in their respective jurisdiction on their own. The Evening Star chart pattern is a common pattern and not just in the Forex currency market as this pattern can appear in the stock market, commodity markets or any other markets. The Evening Star chart pattern is really a minimalist chart pattern. The Evening Star strategy is a simple yet a very powerful Forex reversal strategy.

- However, the drawback of this is that the trader could enter at a much worse level, especially in fast moving markets.

- The evening star is the opposite of the morning star pattern.

- Characteristics, meaning, and how to trade it the most effectively are also available.

- An evening star candlestick pattern is a strong bearish reversal signal, meaning a true evening star pattern only occurs after an uptrend in price.

A short trade location isn’t difficult to ascertain upon identifying the three-candle pattern. If you are new to candlesticks, read our guide to the top 10 candlestick patterns to trade the markets. The evening star is the opposite of the morning star pattern. The Evening Star pattern is a bearish reversal pattern consisting of 3 candles which indicate a sell sentiment. You can see the entry-level marked, and the stop loss placement just above the high of the Evening star structure.

How to trade a Morning Star candlestick pattern?

Like other candlestick patterns, trading forex with evening star patterns is a breeze. All you need to do is recognize the formation (strong bullish candle — Doji — bearish third candlestick), define market entry, set a stop loss, and locate a profit target. A price upswing’s peak, where evening star patterns first appear, is bearish and indicates that the uptrend is about to end. The morning star forex pattern, seen as a bullish reversal candlestick pattern, is the opposite of the evening star pattern. For an example of the evening star candlestick pattern, examine the below chart of Nike stock.

Get free access to our live streams and our market analysts will show you exactly how to read the charts. Test your knowledge of forex patterns with our interactive Forex Trading Patterns quiz. The second https://1investing.in/ day consists of a smaller candle that shows a more modest increase in price. Charles has taught at a number of institutions including Goldman Sachs, Morgan Stanley, Societe Generale, and many more.

When the RSI line is touching the 70 level, we’re in the overbought territory; conversely, when the RSI line is touching the 30 level, we’re in oversold territory. Now, let’s turn our focus back to how to correctly identify and trade the Evening Star chart pattern. Since then we have continuously created the new and improved the old, so that your trading on the platform is seamless and lucrative. We don’t just give traders a chance to earn, but we also teach them how. They develop original trading strategies and teach traders how to use them intelligently in open webinars, and they consult one-on-one with traders.

Are Candlestick Patterns Reliable

Trading the evening star candlestick pattern can be very rewarding, if it is done right. No trader is an expert at this pattern after simply learning to identify it. It takes practice to get a feel for what techniques need to be used and when. Be sure to demo trade this profitable candlestick signal before risking your hard earned money, and it just might become one of your favorite candlestick signals too. Steve Nison recommends trading candlestick patterns using western technical indicators, although many price action traders do well with pure naked charts.

In this lesson, we are going to examine a popular reversal candlestick formation known as the Evening star pattern. The evening star pattern is a chart formation formed over three sessions that signals an upcoming downtrend. It’s the exact opposite of a morning star – a long green stick, followed by a spinning top, and finally a red stick that acts as the beginning of a bearish reversal. This pattern is one of the first candlestick signals that I learned how to trade, and it, along with the morning star candlestick pattern, continues to be one of my favorites. However, these patterns do not occur as often as some of the other strong reversal signals, i.e., engulfing patterns, hammers, and shooting stars. An integral component of a technical trader’s toolkit is the morning star and evening star patterns.

Trading Reversals Using Bullish Reversal Candlestick Patterns

I want to reiterate the difference in graphics when I look at different time frames. While degrading the time frame to the five-minute graph is one way to play this, it’s not an exact science. Remember, RSI is calculated using a certain number of periods; 14 is the most common. For all the basics on how to trade commodities, see our introduction to commodity trading. The bullish equivalent of the Evening Star is the Morning Star pattern.

A candlestick chart with a long bearish candle, a short-lived bullish candle that gaps down from the first candle, and then a long bullish candle is what you want to find. Make sure the pattern is forming at the end of a downtrend or at the end of a consolidation period before trading it. A bullish candlestick pattern known as the morning star forms when there is a downward trend. At the end of a downward trend, three candles are known to form. Although it is pretty rare, the Evening star patterns are considered one of the most reliable and up-to-date technical indicators. These patterns can be seen in the different stock exchanges, forex trading, and indices at any trading platform.

The Evening Star strategy can be broken down into six easy steps. We also have an unorthodox way of reading the price action pattern and from here comes our edge. These are the two best working conditions for this candlestick pattern.

We have described a few here in this article, but that is just the tip of the iceberg. As you can see the rules for this Evening star trading system are quite simple. It is an effective robust trading strategy that works very well given the right market conditions. The Evening star pattern must complete above the 50 day SMA.

Can evening stars be used to trade all securities or only forex pairs?

That is another massive issue with trading this candlestick pattern in the Forex markets, because not all brokers keep the same hours. In other words, your feed may show one of these patterns, but it might only be because the exotic currency trades only during a limited period. Therefore, the pattern is generally not recommended to be traded in currency pairs on the daily chart. Morning star forex patterns are reliable technical indicators for a bullish reversal after a long downward trend. Even though the morning star pattern is quite effective, traders should practice with a demo account and conduct thorough research to reduce risk.

This pattern appears regularly and more confirmation is needed if we were to consider taking a trade at this point. But it’s more likely to appear in upward retracements of a bearish trend. These swing tops create good opportunities for selling the market.

The Evening Star consists of three candlesticks, with the middle candlestick being a star. Evening Star patterns appear at the top of a price uptrend, signifying that the uptrend is nearing its end. Typically, you want to see at least three consecutively bearish candles.